Things you need to consider when using leverage on eToro :

Fees (aka the cost of capital/interest rate)

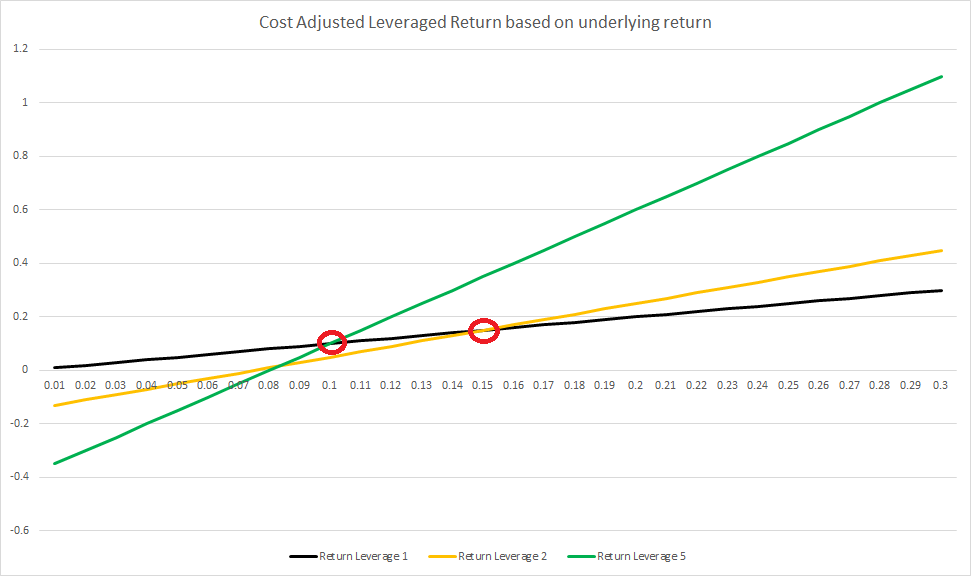

While leverage fees vary from one stock to another, probably mostly based on the risk profile of the underlying and some aspects regarding the stock exchange it’s listed on and its currency, from what I’ve noticed the average costs are the following:

- Leverage 2: $15 / year for each $100 (15% / year)

- Leverage 5: $40 / year for each $100 (40% / year)

Under those costs, the cost-included leverage breakeven concerning unleveraged trade is on the following stock return:

- Leverage 2: 15%/year

- Leverage 5: 10%/year

Stop Loss

Due to regulations, stop-loss can’t be set below 50% on CFDs. As such, your position will be force-closed when the underlying drop by:

- Leverage 2: 25%

- Leverage 5: 10%

As you don’t want that to happen, you need to make sure that either the momentum is strong enough when you get in the trade, or that there’s a significant resistance (a proxy you can consider could be a 1y/2y minimum + a margin of conservatism depending on the volatility of the stock)

Combining the above, you could check the following “flow-chart” when using leverage on eToro :

- The stock could drop more than 25% from its current value. LEVERAGE 1

- The stock won’t drop less than 25% but could drop more than 10%.

- Do you expect the stock to have an annualized return of more than 15%? LEVERAGE 2

- Do you expect the stock to have an annualized return of less than 15%? LEVERAGE 1

- The stock won’t drop less than 10%?

- Do you expect the stock to have an annualized return of more than 10%? LEVERAGE 5

- Do you expect the stock to have an annualized return of less than 10%? LEVERAGE 1

A similar approach should be used for any other trading platform, after replacing the platform specifics such as leverage options, fees, and stop losses.

I’d like to know your opinion about it, let me know if you agree or disagree with the above in the Latex-enabled comment section below.