What is Stock Merger Arbitrage?

What is Arbitrage?

In economics, a strategy that takes advantage of a price difference between two or more markets is called arbitrage.

An easy-to-understand example of arbitrage would be in currencies; suppose you have two exchange offices that have the following set of BUY/SELL prices for EUR/USD

![]()

Under these hypothetical inefficient market conditions, you could secure a guaranteed profit by buying EUR from Office 2 and selling to Office 1.

How can we apply it to stock mergers?

When two companies ![]() and

and ![]() decide to merge, they usually announce a merger rate

decide to merge, they usually announce a merger rate ![]() and a merger time

and a merger time ![]() , usually a few months later.

, usually a few months later.

If at a specific time, the current price rate ![]() is significantly different from

is significantly different from ![]() , we can create a strategy, based on our assumption that the rate will converge to the merger rate (

, we can create a strategy, based on our assumption that the rate will converge to the merger rate (![]() ). As long as the merger holds, our strategy will result in a guaranteed profit.

). As long as the merger holds, our strategy will result in a guaranteed profit.

A look at the current APHA / TLRY merger

The maths:

Two Marijuana Stock companies Aphria Inc. (APHA) and Tilray, Inc. (TLRY) have announced a merger at:

![]()

However, at the time of posting, their ratio is significantly different:

![]()

We can easily see that APHA is relatively undervalued, but can you set your positions to have a guaranteed return (as long as the merger goes through at the agreed rate)?

Let’s denote with A and T the current prices and with A’ and T’ their converged pre-merger prices. Let’s also call ![]() and

and ![]() their current and future ratios.

their current and future ratios.

![]()

Denoting a, respectively t our dollar amount positions of A and T, our return will be

![]()

As we want to remove A’s change from our return, we simply select ![]() , which follows in a return of

, which follows in a return of ![]() . As, in our case,

. As, in our case, ![]() , we simply need a negative value of t, and a corresponding positive value of a, and we get a guaranteed profit.

, we simply need a negative value of t, and a corresponding positive value of a, and we get a guaranteed profit.

The strategy (using today’s values):

Given an AUM of x, we set the following positions:

SHORT TLRY: ![]()

LONG APHA: ![]()

Which will yield a risk-free (except for merger failure) return of:

RETURN: ![]() ( 14%).

( 14%).

Thus, regardless of how far away they drift apart in the meanwhile, and their direction from now, as long as the merger holds at the specified ratio, you will earn a 14% return.

This can be further increased using margin/leverage, after making sure you have a good understanding of your broker’s margin call system / automatic stop-loss.

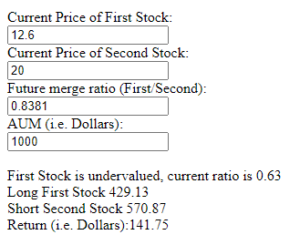

Stock Merger Strategy Calculator:

Use the calculator below to optimize different scenarios:

Due to WordPress limitations, the calculator could not be embedded.

Please use: https://atypicalquant.net/tools/merger_calculator.html