Renault – Passion for Life

🟩 Company Outlook

- Headquartered near Paris, the Renault group is made up of the namesake Renault marque and subsidiaries: Alpine, Gordini, Dacia, Renault Samsung Motors, and AvtoVAZ. Renault also has stakes in Nissan (43.4%) and Daimler AG (1.55%).

- Besides selling cars, Renault manufactures engines for Mercedes A-Class and B-Class cars, offers automotive financing through RCI Banque, sells automotive parts through Motrio, and takes part in motorsports, particularly Formula 1 and Formula E.

- The French government owns a 15% share of Renault.

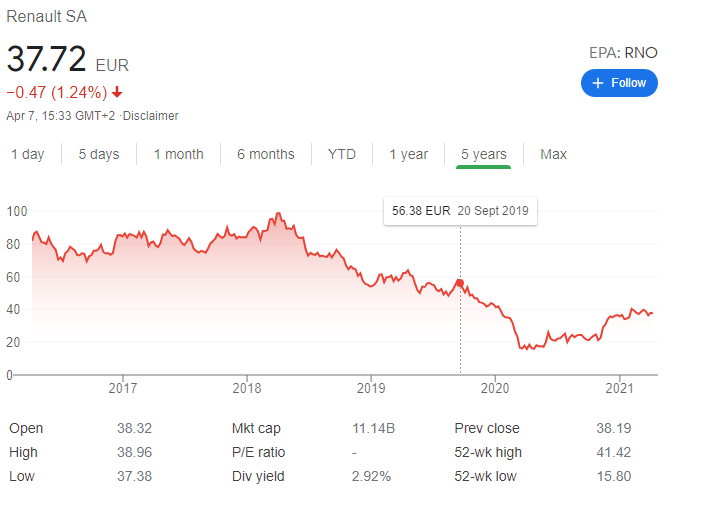

🟩 Financial and Fundamentals of Renault Stock

- 4.2 P/E ratio (VOW3.DE – 14.83, F 179.52)

- 0.25 P/S ratio (VOW3.DE – 0.63, F 0.41)

- 1.24 EV/Rev ratio (VOW3.DE – 1.27, F 1.45)

- Upside potential in analyst estimates (+10% to +100%)

🟩 Growth Prospects

- Renault has a great growth position in the EV Sector. Following investments of

30k)

30k) - Renault has been improving its efficiency, which will increase its margins. A key part of that is increasing platform sharing. For example, as of today, their CMF-B platform is used by 8 different car models: Renault Clio V, Renault Captur II, Renault Arkana/Mégane Conquest/Renault Samsung XM3, Nissan Juke — F16, Nissan Note — E13, Dacia Logan III, Dacia Sandero III, Renault Taliant.

- Renault has been struggling with a long-lasted bad reputation when it comes to reliability. However, as most statistics show, their cars have become a lot more reliable and consumers are beginning to trust the brand more. This could also be due to their efforts in understanding and appealing to customers, as demonstrated in this video posted on their official channel:

- Dacia Duster, the budget SUV, has been one of the best-selling models from the Renault Group. The upcoming 2021 Facelift, the announced 2023 Duster redesign as well as the spin-offs Dacia Grand Duster (replacing Dacia Lodgy) and Dacia Bigster (a bigger and chunkier version), are a part of the 2025 plan. Taking advantage of the SUV-craze that shows no signs of slowing, I’m confident they will help Renault’s bottom line.

TL;DR: Renault Stock is a good value play, given its financials and dividend yield, a great recovery play (both on an individual level and on a CAC40 level), and a company that has a robust plan for growth in the years to come, staying true to their (ex) motto “Cars For Living”