Nowadays, you have plenty of resources that you can use to learn whatever you desire:

- Youtube channels

- Online courses

- Specialized forums

While these are very convenient, they usually deal with things only at a superficial level. If you want to truly understand some concepts, and dig deeper into the details, books are still a better option. While, for convenience, you can go for e-books, personally, I love physical books. There’s a certain je ne sais quoi in flipping the pages, making markings with a pencil, and shaking off the dust from a book that no Kindle can offer.

This 2018 meta-analysis on the effects of the reading medium on comprehension included 54 studies and a total of 171,055 participants. The conclusion was that comprehension is better when people read print versus digital text; this was both true on an overall level and also when split by study type (between-subjects vs within-subjects).

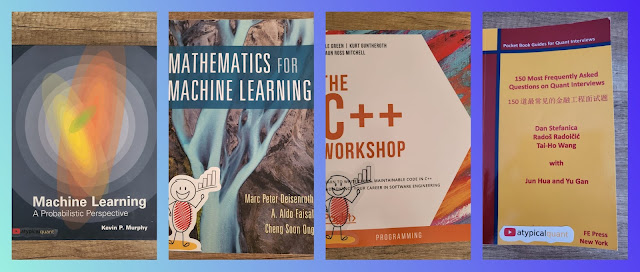

If I’ve made a compelling point and you’re up for a read, here are some of the Quant Interview Preparation Books that I would recommend you go through if you want to Ace your next interviews:

I. Problem-Solving

1. Heard On The Street: This is the first and the original book of quantitative questions from finance job interviews. Painstakingly revised over 19 years and 15 editions, Heard on The Street has been shaped by feedback from hundreds of readers.

2. Quant Job Interview Q&A: This book contains 300 interview questions from actual interviews in the City and Wall Street. Each question comes with a full detailed solution, a discussion of what the interviewer is seeking, and possible follow-up questions. Topics covered include option pricing, probability, mathematics, numerical algorithms, and C++, as well as a discussion of the interview process.

3. Most Asked Quant Interview Questions: This book contains over 150 questions covering this core body of knowledge. These questions are frequently and currently asked on interviews for quantitative positions, and cover a vast spectrum, from C++ and data structures, to finance brainteasers and stochastic calculus. Answers are also included :).

4. Cracking the Code Interview: Authored by Gayle Laakmann McDowell, a former Google software engineer, this book is a go-to resource for mastering technical interviews. Packed with real-world examples and practical insights, it offers effective strategies to tackle coding challenges commonly encountered in job interviews. McDowell’s expertise and concise approach make it a must-have guide for acing coding interviews and securing tech roles.

5. Quant Job Interview Questions and Answers: Written by Mark Joshi and Nick Denson, this book provides invaluable guidance for acing quant job interviews. With its focus on quantitative finance, the book covers a wide range of topics essential for quant roles. It includes comprehensive answers and explanations to intricate questions, drawing from the authors’ expertise in the field. Whether you’re a novice or an experienced quant, this book equips you with the knowledge and confidence needed to excel in quant job interviews.

II. The quant trifecta: Maths, Stats, and C++

1. Probability and Statistics: Ensure you’re getting the latest revision, including a chapter on simulation (including Markov chain Monte Carlo and Bootstrap), coverage of residual analysis in linear models, and many examples using real data. 🙂

2. Statistics and Data Analysis for Financial Engineering: David Ruppert’s guide bridges statistics and finance. With real-world examples, it demystifies statistical methods within financial analysis. This essential resource, rich in practical insights, connects theory to financial application. Ideal for those delving into financial engineering, it’s a concise path to mastering statistical techniques for the financial world.

3. Stochastic Calculus for Finance I & II: Steven Shreve’s two-part series demystifies stochastic calculus in finance. With clarity and depth, these books unravel complex concepts, enabling readers to navigate financial models with confidence. Practical applications, real-world insights, and Shreve’s expertise make these guides indispensable for mastering the intersection of stochastic calculus and finance.

4. Mathematics for Machine Learning: The fundamental mathematical tools needed to understand machine learning include linear algebra, analytic geometry, matrix decompositions, vector calculus, optimization, probability, and statistics. This self-contained textbook bridges the gap between mathematical and machine learning texts, introducing the mathematical concepts with a minimum of prerequisites.

5. A tour of C++: Like it or not, most quant shops require C++, some due to legacy code, but most simply for efficiency.

In A Tour of C++, Second Edition, Bjarne Stroustrup, the creator of C++, describes what constitutes modern C++. This concise, self-contained guide covers most major language features and standard-library components. Coverage begins with the basics, includes C++17, and even covers some extensions being made for C++20.

III. Finance and Financial Instruments

1. Options, Futures, and Other Derivatives: Unveiling the world of derivatives, it explores options and futures intricately. With comprehensive insights and practical examples, Hull’s expertise and clear explanations empower readers to grasp the complexities of financial derivatives, making this book a must-read for those delving into this dynamic field.

2. An Introduction to Mathematics of Financial Derivatives: Salih N. Neftci’s book offers a lucid entry into financial derivatives mathematics. From basics to intricate concepts, the book navigates readers through derivative pricing models. Neftci’s approach, combining theory and application, makes this guide essential for grasping the mathematical underpinnings of financial derivatives.

3. The Concepts and Practice of Mathematical Finance: Mark S. Joshi presents “The Concepts and Practice of Mathematical Finance,” an indispensable resource. Covering a wide array of mathematical finance concepts, this book delves deep into quantitative methods. Joshi’s expertise and practical approach render this guide invaluable for understanding and applying mathematical finance principles.

4. Financial Modelling: authored by Simon Benninga, is a comprehensive guide to the art of financial modeling. From valuation to risk assessment, this book equips readers with practical tools and techniques. Benninga’s clarity, supported by real-world examples, makes this guide essential for honing financial modeling skills.

5. Paul Willmott introduces Quantitative Finance: which provides a dynamic entry into quantitative finance. Paul Wilmott’s book captures the essence of the field, unraveling intricate concepts with real-world relevance. From derivatives to risk management, this guide is a recommended read for those seeking a comprehensive introduction to quantitative finance.